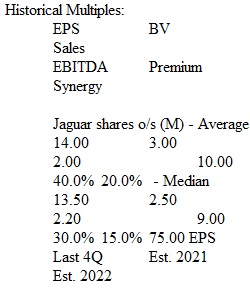

Q FINE 332 Corporate Finance I Module 6 Problem Set Multiples and Transactions, Dividend Discount Module All the data you need is in the template provided to you. 1. JTM Airlines is looking to buy Jaguar Airlines. Your boss, the CFO, wants a quick and dirty valuation of Jaguar. You choose to look at past transactions in the airline industry to get some numbers and put them in an Excel spreadsheet. For Jaguar, you find out the firm's key financial values and put them in the spreadsheet. To remind yourself that they are inputs, you should color them red. Using EPS, Book Value (BV), Sales, EBITDA, Premium and Synergy over stock price, what should be Jaguar's prices per share? 2. Your boss is piling on the work and has asked you to value three more potential acquisitions. They are of Northern, Eastern and Central, fixed base operators serving areas where JTM is looking to expand (the names give away the regions of the country). You don't have cash flow data for these firms as they are privately held, but you talked to the owners and they gave you dividend information for the firms, which you entered into your spreadsheet. You remember back to your corporate finance class that you can use the Dividend Discount Model (DDM) to come up with a quick and dirty valuation. You know JTM's WACC and will use this as the applicable discount rate. Using the DDM Model, what are the values per share of each of these three firms? FINE 332 | Jan ’22 | worldwide.erau.edu All rights are reserved. The material contained herein is the copyright property of Embry -Riddle Aeronautical University, Daytona Beach, Florida, 32114. No part of this material may be reproduced, stored in a retrieval system, or transmitted in any form, electronic, mechanical, photocopying, recording or otherwise without the prior written consent of the University.

View Related Questions